The Algorand blockchain is an open-source pure-proof-of stake consensus built on the Byzantine protocol. Its token economy is well designed to offers value to all stakeholders on the network. ALGO is the name of the native token of Algorand. The token has important uses such as paying for network fees when a transaction is processed and rewards users who hold the coin in their wallet, i.e, staking it. By default, users who hold the ALGO token in their Algorand wallets earn daily rewards and it is credited to their wallets instantly.

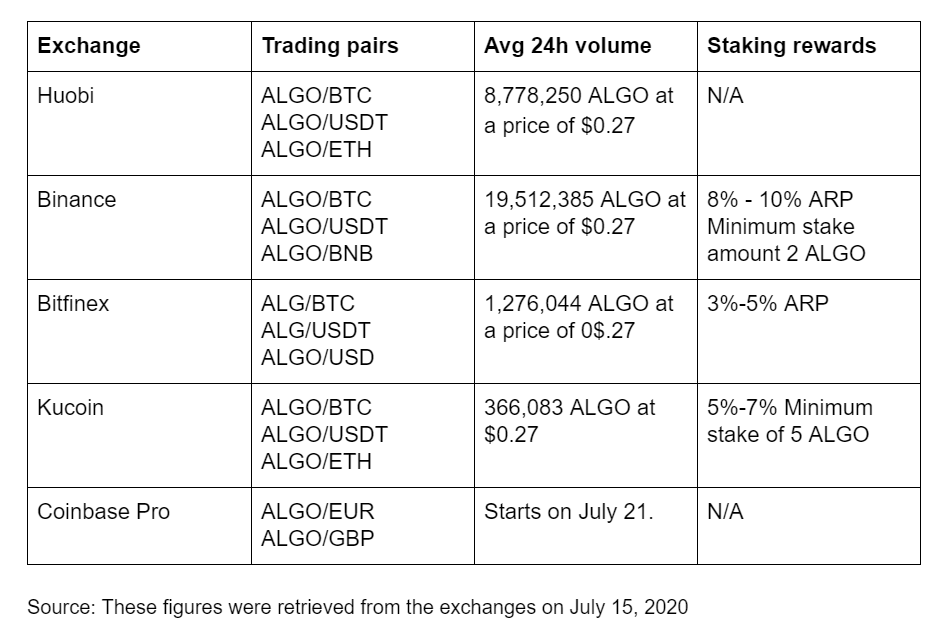

However, the huge proportion of the Algo coin is traded on various crypto exchanges against several coin pairs. Coin holders can also stake Algo coin, and earn a percentage on most of these exchanges as well. I did a scout of the major exchanges and gathered information on the trading pairs, the average 24hr market volume and the staking terms on each platform. The statistics are captured in the table below.

In general, Algo is traded against three major currencies and stable coins name BTC, USDT and ETH. BTC and USDT remain the constant denominator across all exchanges except Coinbase Pro. There is also the ETH trading pair though the trading volumes are low across exchanges for this pair. BNB emerged as the unique crypto trading pairs on Binance. Exciting though is the emerging of direct crypto to fiat pairs. Coinbase Pro has the EUR and GBP pairs while Bitfinix has the USD trading pair only. Generally, staking rewards range from 5% to 10% APR across the board. The absence of Algorand staking on Huobi exchange is surprising. Each exchange has its unique pairings and trading volumes. The ensuing section is an analysis of exchange and its Algorand trading activities.

- Binance is the leading exchange for Algo in terms of trading volumes and staking rewards. There are 3 trading pairs: ALGO/USDT, ALGO/BTC and ALGO/BNB. In terms of trading volumes by pairs, the ALGO/USDT pair is the highest traded pair on Binance, accounting for up to 19.5 million ALGOs over a 24hr period using the trading data for July 15. The BNB pair is the unique observation in the pairing on Binance which is understandable since BNB is the native token of Binance. In comparison with the other exchanges, Binance has the highest trading volume over a 24hr period and this observation was using data for the ALGO/USDT pair across all exchanges. In terms of staking, the exchange offers 6% to 10% ARP which is by far the highest on the market, a rate higher than you will get by holding Algo in your Algorand Wallet.

- Huobi: For Huobi, it is pairing the Algo coin with USDT, BTC and ETH. The USDT pair is the most active pair with the ETH pair recording very low trading volumes. It is striking that Huobi doesn’t have staking support for Algo though they among the first to announce support for Algorand staking. I must admit they offer limited staking options on their platform it may be a company decisions to scale down on staking. Huobi is the second Algo trading exchange in terms of volumes, using the 2 major trading pairs of USDT and BTC.

- Bitfinex: This exchange has a USD pair which is traded differently from the usual USDT pair, and surprisingly it records the highest trading volumes in on the exchange. It would be logical to assume that, the USDT pair would follow similar trends as Binance and Huobi to record the highest trading volumes but it turned out to be USD pair. Awkward, however, is the low staking rewards that Bitfinex promises users. The ARP ranges from 3%-5%, rates that are lower than holding Algos in your Algorand Wallet.

- Kucoin: Kucoin has the lowest trading volumes across exchanges as at the time of compiling this but with a slightly higher staking rewards rate than Bitfinex and Algorand wallet. It is trading Algos against the known trading pairs of USDT, BTC & ETH. It seems lucrative to stake your Algos on this exchange.

- Coinbase Pro: Coinbase is one of the leading crypto exchanges serving the European market. Its key strength is the integration of crypto ecosystem with fiat infrastructure. Hence, it is easier to connect your bank account and debit cards on Coinbase for buying and selling. Customers can buy crypto with their bank accounts or debit cards as well as withdraw the crypto directly to their bank accounts. Recently, Coinbase announced plans to launch Algo coin for its Coinbase Pro users. The exchange is paring the Algo coin against fiat currencies of EUR and GBP. This is a complete departure from the other exchanges who are mostly paring Algo against other cryptocurrencies. Expectedly, the launch of the ALGO to fiat pairs further boosts the liquidity options for buying and selling Algo for the European market.

Suffice to add that some of the exchanges, such as Binance, offer futures trading on the Algorand Coin. If fact, you can leverage on up to 5x in order to maximize your trading gains on Binance. Across the exchanged, USDT and BTC are the regular trading pairs but the emergence of fiat pairs presents more options for adoption and liquidity for the coin. You can gain more rewards by trading and staking your Algo on these exchanges for profits and liquidity as well. The availability of the Algorand coin on these leading cryptocurrency exchanges denotes trust in the project as well as the availability of liquidity for the coin. Trading volumes are also growing across the exchanges.

This store was first published here